Inflation Threat Looms over Oil Markets

Analysis by Alan Apthorp

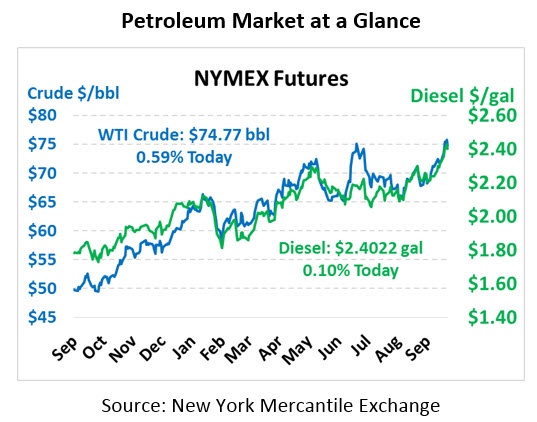

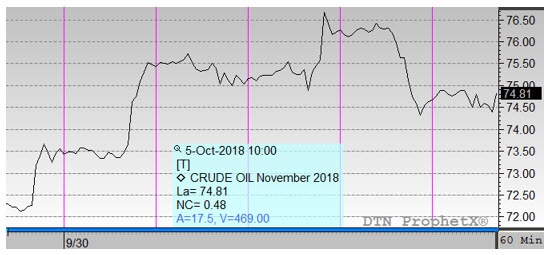

Markets saw a large downward reversal yesterday after gaining over $4/bbl in 3 days. Even with a hefty loss of $2/bbl yesterday, prices are still positive overall this week. Crude is currently trading at $74.77, a gain of 44 cents.

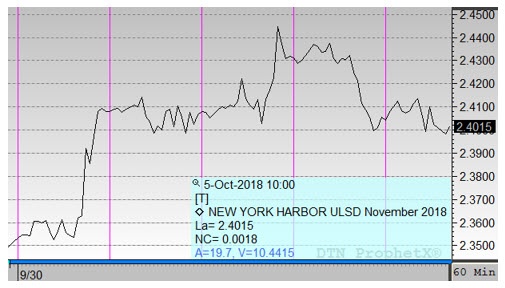

Fuel prices both gave up a fair share of this week’s gains yesterday, though both are still trading net-higher this week. The oil complex is going back and forth between positive and negative territory this morning. Diesel prices are currently trading at $2.4022, a small gain of 0.3 since yesterday’s close. Gasoline prices are $2.1000, virtually flat to yesterday’s closing price. .

Although oil markets have posted more bearish than bullish headlines lately, yesterday’s sell-off doesn’t quite leave the feeling that the bears are winning. Profit-taking is a common response to rapid gains in oil prices. The downturn also came after the September jobs report was released showing an uptick in wages and a 50-yr low in unemployment. The labor report caused bond yields to rise (a sign of higher inflation), which in turn strengthened the dollar and caused commodities and financial markets to turn lower.

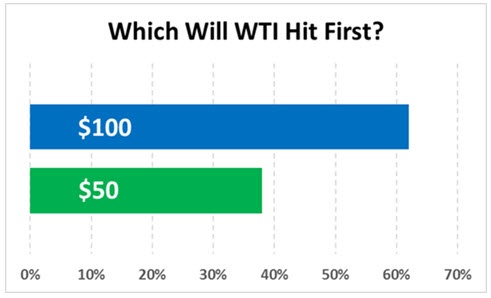

Survey Says…

Yesterday in FUELSNews, we asked our readers which they thought was more likely – crude hitting $100 first, or $50 first. And the winner is - $100, with 62% of the vote! For fuel prices, that represents a potential 60 cent increase!

Want to learn more about where fuel prices will end 2018? Pre-registration is now open for our quarterly FUELSNews 360 Webinar on October 16. Sign up now to learn more about fuel market trends and what’s driving prices.

Week in Review

Analysis by Alan Apthorp

Prices have been fluctuating wildly this week – with massive gains giving way to rapid losses. Markets are in untested territory. As we’ve noted before, the $70-$75 range for WTI is one of the least common price levels over the past three years. Prices only pass through this range when shooting higher (2009) or plummeting lower (2014).

For technical traders (who use statistical models to find market patterns that repeat over and over), the lack of historical activity in this range leaves prices open to fluctuate largely. Based on historical trends, prices move rapidly through $70-$75, so why should this time be different? Markets have more room to run the higher prices get, which is why we’ve seen $1-$2 market swings per day rather than smaller fluctuations. Until markets get more comfortable with the $70 range, or until they move to a more comfortable range – expect volatility to continue.

Price Review

After a lumpy week of increases and declines, WTI crude prices remain in the black for the week, but far from their high water mark. Crude began the week at $73.29, already a high level compared to recent weeks. Prices quickly ramped up during the week despite a lack of strong bullish news – in fact, prices hit a new multi-year high of $76.90 on the day the EIA showed an 8 million barrel crude build! Yesterday brought lower prices as inflation concerns picked up, which strengthened the dollar. Prices opened this morning at $74.67 – well below the high point of the week but still a weekly gain of $1.38 (1.9%), a relatively large weekly increase.

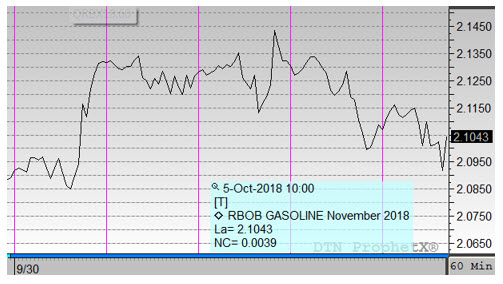

Like crude, fuel prices saw early week gains followed by a Thursday reversal. Diesel prices began the week at $2.3531, quickly jumping above $2.40 by the end of Monday’s trading session. Prices remained at that level for most of the week, increasing as high as $2.45 on Wednesday before dropping lower. This morning diesel opened at $2.4024, a weekly gain of 4.9 cents (2.1%).

Gasoline prices are the most at risk of dropping to a net loss for the week. Gasoline began the week at $2.0908, picking up 3 cents on Monday and reaching a weekly high of $2.15 on Wednesday before reversing lower. This morning, gasoline opened at $2.1105, a gain of 2.0 cents (0.9%), though prices have dropped a bit lower during morning trading.